haven't filed taxes in 5 years what do i do

What happens if you havent filed taxes in 5 years. For each return that is more than.

Can The Irs Take Or Hold My Refund Yes H R Block

Tax not paid in full by the original due date of the return.

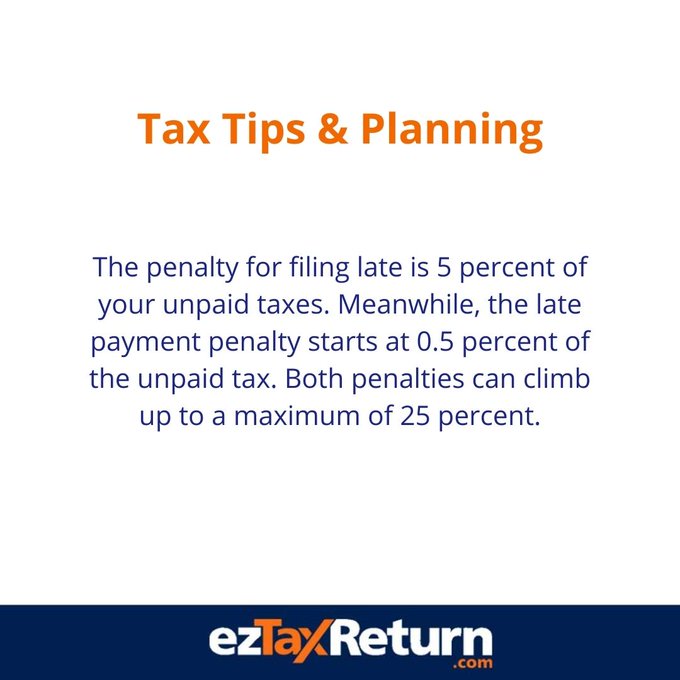

. What do I do if I havent filed taxes in 5 years. She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for. This penalty is usually 5 of the unpaid taxes.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. The penalty charge will not exceed 25 of your total taxes owed. Havent Filed Taxes in 5 Years Its too late to claim your refund for returns due more than three years ago.

Most people will do this in chronological order so they can use any tuition credits or claim. You just need to file your taxes for each individual year that youve missed. The timeframe for claiming a refund is normally three years after the tax return is filed or two years after the taxes are paid.

If you havent filed a tax return in a few years the IRS will pull your tax documents from those years and use them to calculate your tax. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of. Then you have to prove to the IRS that you dont have the means to pay.

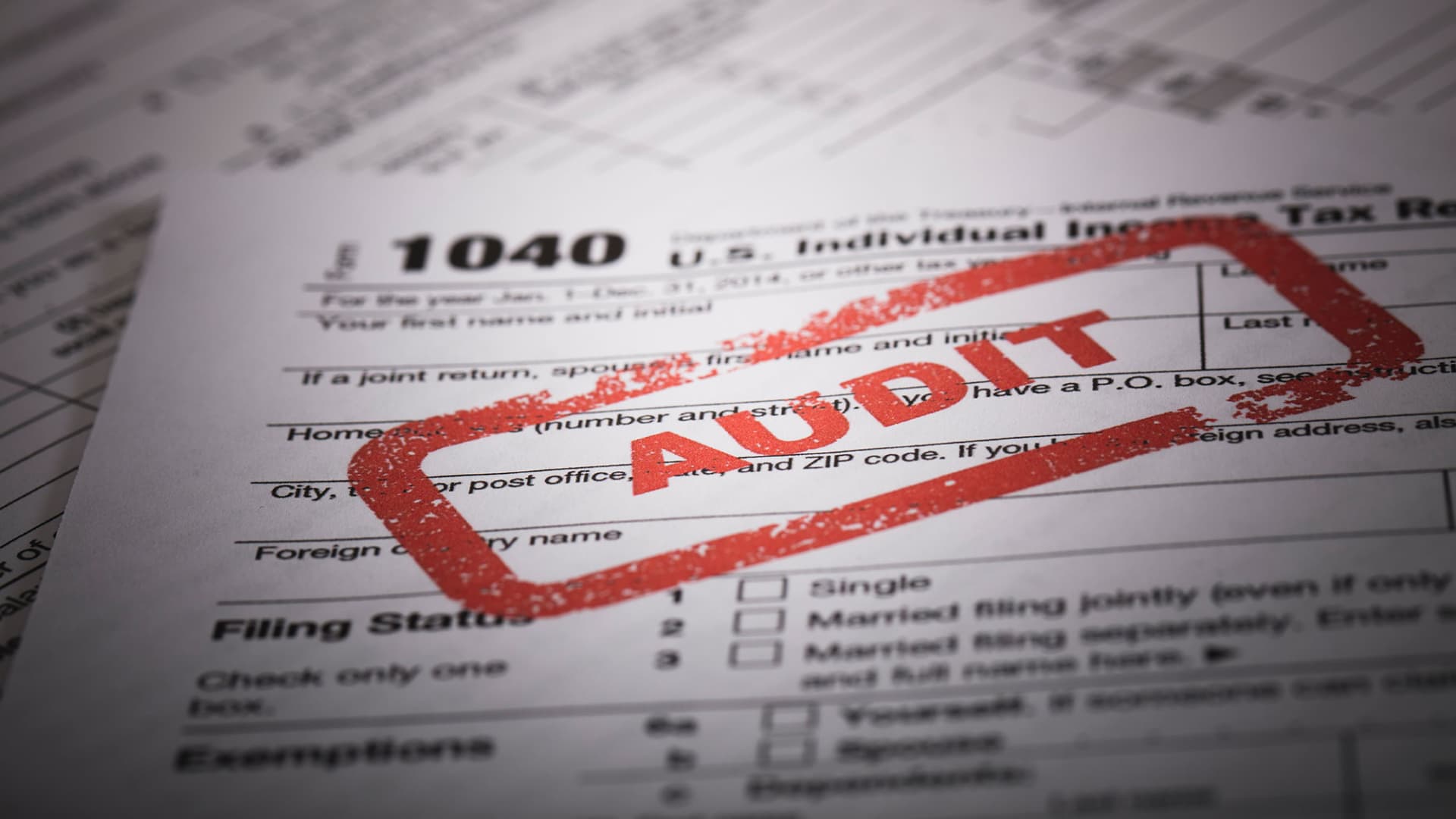

If the IRS finds that you owe tax that you did not report on your return even if the return was filed on time it will send you a notice or letter with the amount due and a due date. It depends on your situation. The IRS recognizes several crimes related to evading the assessment and payment of.

The deadline for claiming refunds on 2016 tax returns is April 15 2020. Failure to file or failure to pay tax could also be a crime. This is because the CRA charges penalties for filing and paying taxes late.

If you owed taxes for the years you havent filed the IRS has not forgotten. Then start working your way back to 2014. Havent Filed Taxes in 5 Years If You Are Due a Refund.

The IRS doesnt pay old refunds. But if you filed your tax return 60 days after the due date or the. For every year that you did not file a tax return you should gather your W-2s or 1099 forms.

The first step of filing your taxes is gathering paperwork and documents. However you can still claim your refund for any returns. Confirm that the IRS is looking for only six years of returns.

The longer you wait to file your taxes the more penalties you will owe and the likelihood of the CRA seeing your avoidance as tax evasion. Input 0 or didnt file for your prior-year AGI. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes.

For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available. Lets start with the worst-case scenario. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure to file timely.

No matter how long its been get started. After the expiration of the three-year. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years.

For example if you need to file a 2017 tax return. If you cannot find these. What happens if I havent filed taxes in 5 years.

This does not mean you. If you earned 18200 or less in the past financial year AND you had no tax withheld from that income you might not be required to lodge a tax return. Some tax software products offer prior-year preparation but youll have to print.

As soon as you miss the tax deadline typically April 30 th each year for most people there is an automatic late. Its too late to claim your refund for returns due more than three years ago.

Here S What Happens If You Don T File Your Taxes Bankrate

Still Haven T Done Your Taxes How To Get Help

I Haven T Filed Taxes In 5 Years How Do I Start

5 Things To Know If You Haven T Filed Your Taxes Yet 12news Com

Haven T Filed Your Tax Return The Penalties Are Coming Nerdwallet

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Nothing Like The Last Minute Tax Filing Tips For Corporations Inc Com

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Irsnews On Twitter The Federal Income Tax Deadline Has Passed For Most Individual Taxpayers However Some Haven T Filed Their 2020 Tax Returns Or Paid Their Tax Due Https T Co 2e6vpmcnko Irs Https T Co Bjjzez89qm Twitter

Can T File Your Tax Return By Midnight Here S How To File A Tax Extension Cnet

What Happens If You Don T File Taxes For Your Business Bench Accounting

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

Trying To Reach The Irs Very Few Callers Getting Through

Unfiled Tax Returns Guidelines And Info On Filing Tax Returns Late

I Haven T Filed Taxes In A While How Do I Claim The Child Tax Credit Marca

Here S What Happens When You Don T File Taxes

How To File Taxes If You Haven T Filed In Years Youtube

Where S My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You Cnet

These Are The Top Reasons Your Tax Return May Be Flagged By Irs